Volatility Matters

June 16, 2025 - Have you heard the phrase, "As long as you get the best returns, volatility doesn’t matter"? When it comes to investing, that’s simply not true.

In reality, the math tells a different story. Reducing volatility is key to maximizing long-term, compounded returns. A portfolio (like portfolio B below) with steady, more predictable performance will generally accumulate more wealth than one with the same average return (like portfolio A below) but greater volatility. This concept is foundational to long-term investing success.

Understanding Volatility

Volatility refers to the degree of fluctuation in the value of an investment over time. While it’s often viewed as just a measure of risk, it directly affects how much wealth your portfolio can accumulate. Here's why: when returns swing widely from year to year, the compounding effect works against you. Losses require greater gains to recover, and inconsistent returns decrease overall growth.

The Role of Diversification

One of the most effective ways to manage volatility is through diversification, investing across different asset classes such as stocks, bonds and real estate. Because these assets don’t move in sync, diversification helps smooth out the ups and downs in your portfolio.

It’s not just about reducing risk, though. Diversification also protects asset values during downturns and boosts your chances of achieving consistent long-term results. Trying to predict which asset class will perform best each year is notoriously difficult. That’s why a disciplined, strategic allocation maintained over time is far more effective than making frequent, tactical shifts.

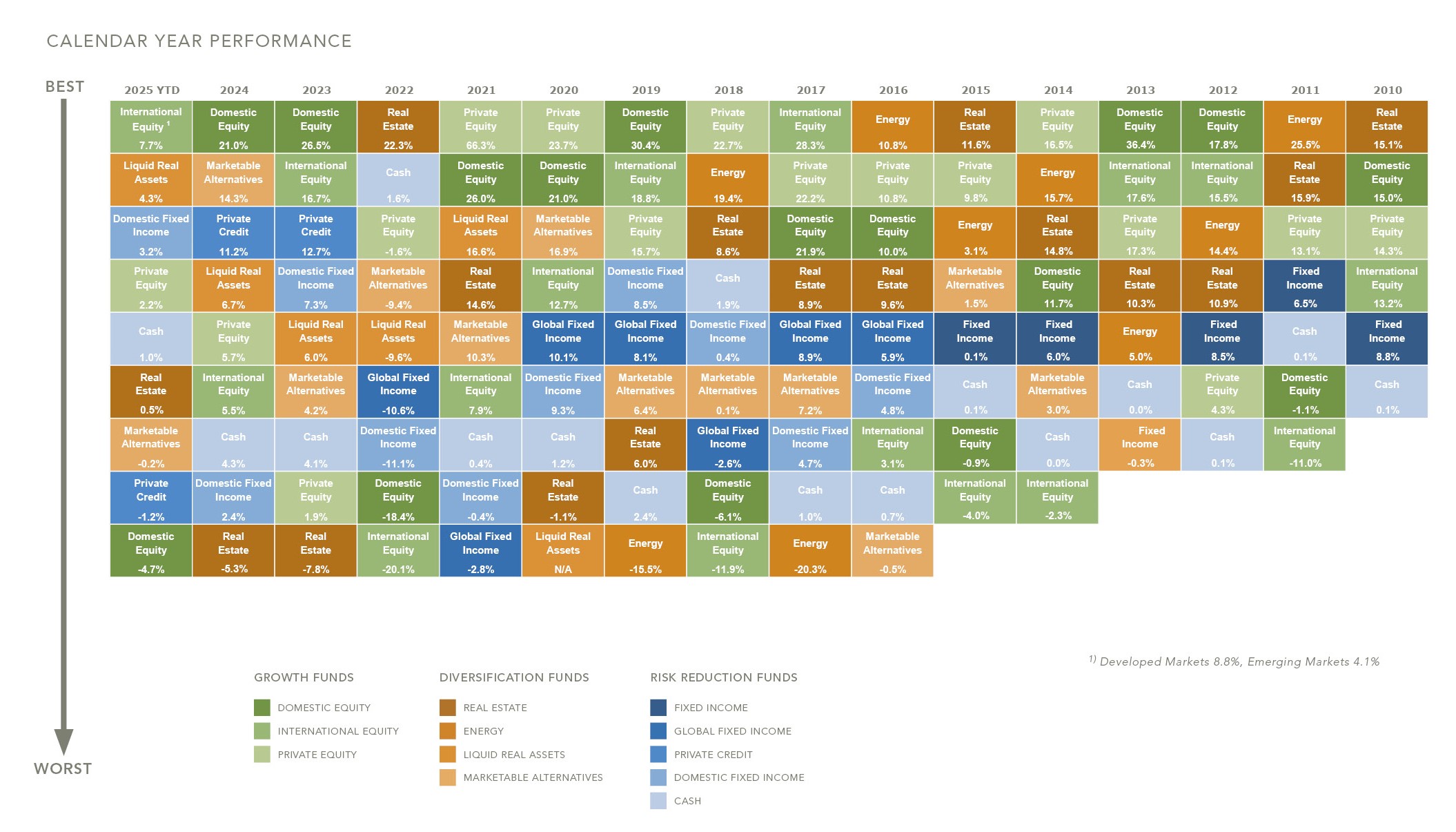

The Power of the "Quilt Chart"

To clarify this point, consider the "quilt chart," which presents asset class funds available through HighGround. Each column represents a calendar year, and the colored boxes show the ranked performance of different asset classes from best to worst. As you move across the years, two things become immediately clear:

- The Benefits of Diversification – Over time, the number of asset classes has expanded, increasing the benefit of diversification and return potential for a blended portfolio of multiple asset classes. Since asset classes are not perfectly correlated, when one declines, another often rises, mitigating risk over time.

- The Unpredictability of Returns – Asset classes frequently trade places from year to year. The best-performing asset class one year may be among the worst the next. This unpredictability makes a strong case against chasing performance and reinforces the value of a diversified approach.

Final Thoughts

Highground’s basic investment philosophy centers on five tenets: asset allocation, long-term focus, active management, disciplined process and diversification. We believe better-diversified portfolios have greater potential for long-term growth with prudent risk levels. Spreading investments into different equity and fixed income markets, while also investing in non-traditional alternative asset classes, is the best defense for softening market volatility. Return streams of well-diversified strategies are expected to be less volatile because performance correlations among individual asset classes tend to vary with one another, reducing overall portfolio volatility. In other words, when one asset class “zigs,” others “zag,” tempering volatility and protecting asset value when capital markets experience dramatic downdrafts.

For help developing an investment strategy aligned with your mission and grounded in these tenets, reach out to HighGround Advisors at 214.978.3300 or info@highgroundadvisors.org. We’re here to support your nonprofit’s long-term success.