A donor-advised fund (DAF) is a charitable giving account that enables donors to maximize their charitable impact.

One of the fastest-growing and most flexible giving tools, a DAF allows donors to give in a tax-advantaged way, streamline the giving process, involve their family, and leave a legacy of generosity.

At HighGround, we like to say that a DAF allows donors to Give, Grow, & Grant.

Donors make tax-deductible contributions of cash or noncash assets to their donor-advised fund.

Contributions are invested and have the potential to grow, tax-free.

At any time, donors may recommend grants from their donor-advised fund to the IRS-qualified U.S. charities of their choice.

| Tax-Effective | Flexible | Easy |

|---|---|---|

| Invest your tax-deductible DAF contribution to grow, tax-free | Select investment options that align with your risk tolerance & expected giving time horizon | Monitor your fund balance, contributions and grant history through the online DAF portal |

| Contribute appreciated assets, such as securities, mutual funds or real estate, and avoid capital gains tax exposure | Recommend grants to one or more charities, in the short-term or long-term | Ease the administrative burden of your giving, as HighGround performs due diligence, processes grants, and provides tax receipts |

| Reduce the income tax burden of a financial windfall by contributing the extra income to your DAF, prefunding years of charitable giving | Choose to receive recognition or to remain anonymous with each grant | Funnel all your charitable giving through your DAF and receive one contribution tax receipt at year-end |

| Reduce estate taxes and the inheritance tax burden on loved ones by bequeathing estate assets to your DAF | Involve the family and create a legacy of giving with a DAF succession plan | Recommend grants to qualified 501(c)(3) charities at any time and from anywhere through the online DAF portal |

How dafs work |

DAF Program Guide |

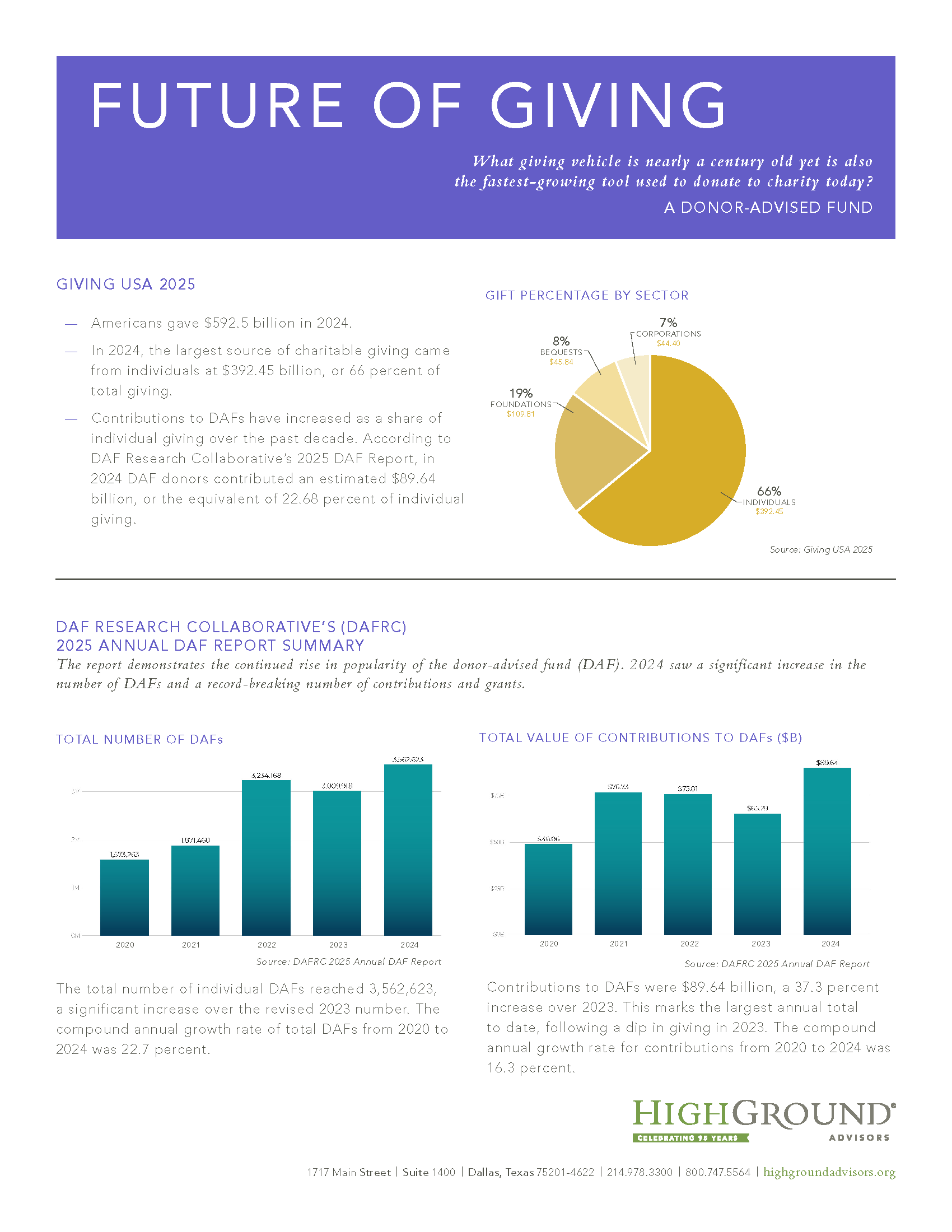

2025 DAF Report |